This scenario shows how applications use trusted data within the blockchain and corporating seamlessly in real-time based on a reliable state.

Suppose a loan company A and a bank B are in the market. When company A receives a customer applies for a loan, it must verify the customer’s private asset in bank B for approval.

Usually, the customer should provide a paper certificate from bank B to company A, which is slow, exposed, and easy to fake. Blockchain technology could make the whole process safe, efficient, and trustworthy.

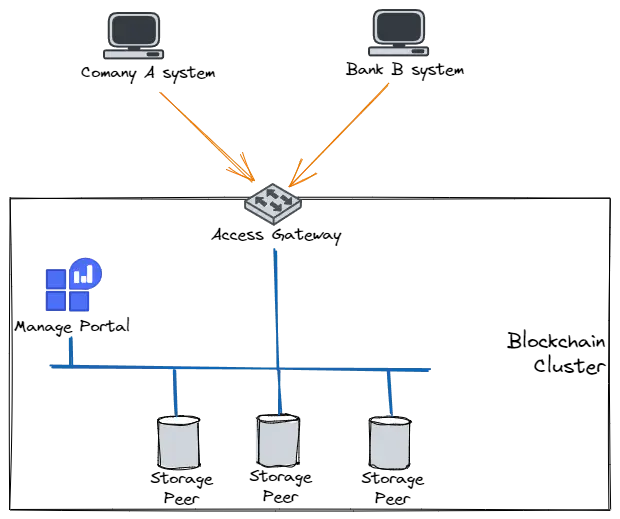

The blockchain system in this scenario includes three storage peers, a portal, and an access gateway. The business systems of company A and bank B connect to the blockchain via the gateway, as shown in the following figure:

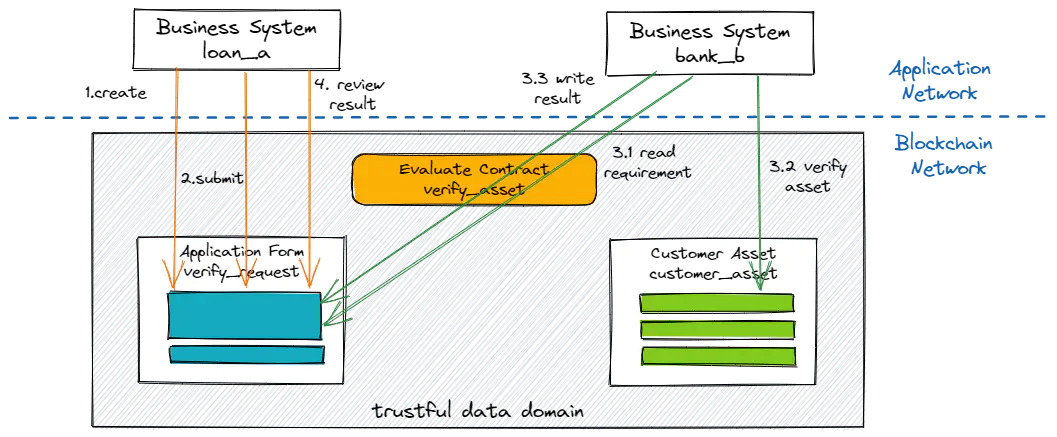

The employees of Company A create a loan application with the minimum asset requirement, then transfer it to Bank B for manual or automatic approval.

This process will not expose privacy about the client’s asset detail but could validate whether it meets the requirements. The system approves results in real-time and guarantees reality and validity using digital signatures.

This method that two systems corporate directly without customers’ participation dramatically improves efficiency and eliminates data distortion.

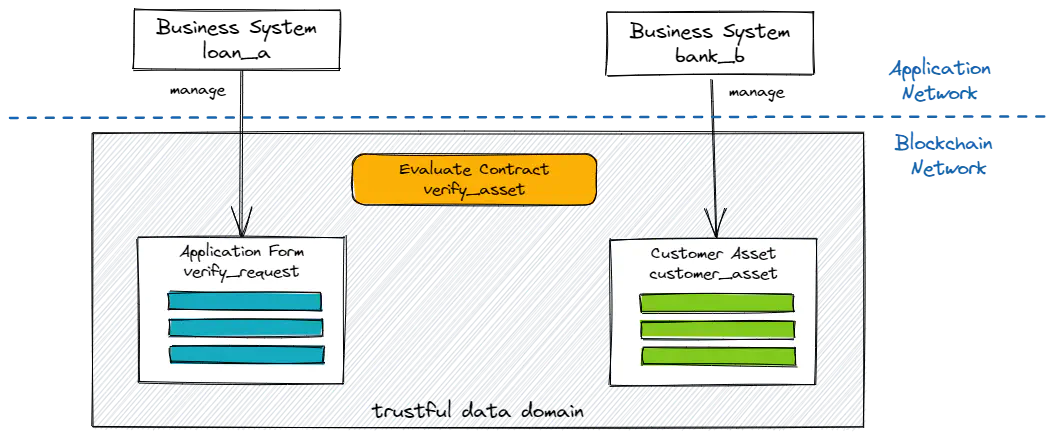

The systems collaborate base on the digital assets which identified by ID in a blockchain. Company A creates and maintains the data schema verify_request which defines the loan application form in the blockchain system.

| Parameter | Value Type | Description |

|---|---|---|

| customer | String | ID of Borrower |

| amount | Currency | Loan amount |

| minimum_asset | Currency | Minimum asset required |

| creator | String | ID of Creator |

| create_time | String | Form creation time |

| status | Integer | Request status: 0 - idle, 1- approving, 2 - complete |

| bank | String | Verification bank |

| invoker | String | ID of Invoker |

| invoke_time | String | Form invoke time |

| verify_mode | String | ‘manual’ - manual approve, ‘contract’ - smart contract |

| result | Boolean | Whether is approved |

| verifier | String | ID of verifier |

| verify_time | String | Form verification time |

| comment | String | Comment on approval |

Bank B creates and maintains the data schema customer_asset that defines the personal asset records. When validating client assets, it is associated to the field ‘customer’ of verify_request.

| Parameter | Value Type | Description |

|---|---|---|

| customer | String | ID of customer |

| asset | Currency | Current total assets |

| cash_flow | Currency | Cash flow in 6 months |

| status | Integer | 0 - Normal, 1 - Alert, 2 -Suspend |

| register_time | String | Register time of customer account |

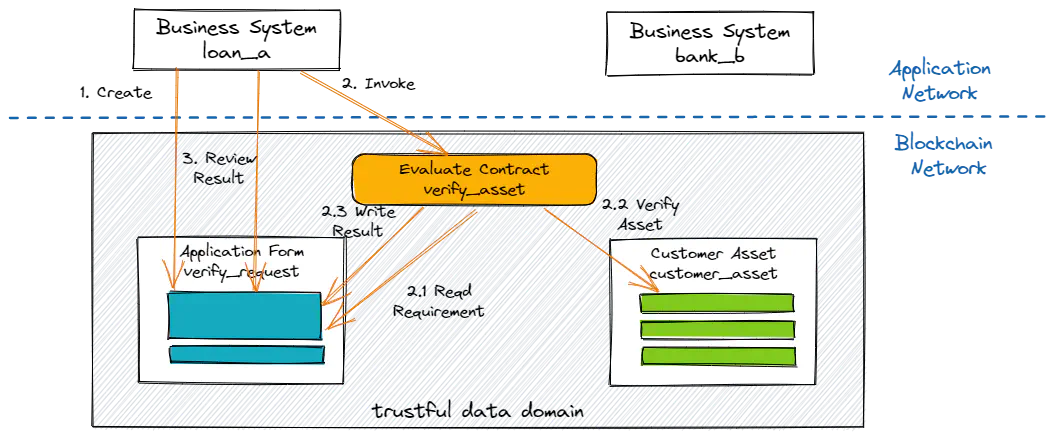

There is also a smart contract verify_asset defined in the blockchain, which validate personal asset by customer ID and write result to application.

Operations

You could follow the instructions, or explore freely.

Use Case 1: Manual Approve

- Go to the company A system, click “create application” to create a form.

- In the application list, select the form and submit to Bank B using “manual approve”.

- Go to the B bank system, review the details of the form, submit the approval result.

- Check the approval result in the company A system

Use Case 2: Automatic Approve

- Go to the company A system, click “create application” to create a form.

- In the application list, select the form and invoke the smart contract using “automatic approve”.

- Check the approval result

You could review change history, related transactions and chain record of all data generated in the system.